Effective Intelligence RCM Scorecard - Power BI Report Training

Power Bi is an analytics tool designed by MedEvolve to allow practices to have real time insight into key metrics. It allows the end user to quickly diagnosis the health of the practice based on financial metrics.

Key Metrics Definitions

Below are the definitions of each item that makes up the Key Metrics Tab on the MedEvolve RCM Scorecard.

- Charge Lag: The Average number of days that pass between the Service Date and the first charges post date on the visit.

- New Patient Visit %: Percentage of visits that recorded a new patient procedure code (90791, 90792, 99201, 99202, 99203, 99204, 99205, 99217, 99218, 99219, 99220, 99221, 99222, 99223, 99234, 99235, 99236, 99239, 99241, 99242, 99243, 99244, 99245, 92002, 92004, 92070

- OTC Collections / Office Visit: The average collection from a patient per visit at an office location. OTC Collections are Private Payments posted within 7 days of the Service Date.

- Completed Appointments: Any appointment that has passed that has not been marked as Cancelled, No Show, Missed, Rescheduled or Not Seen.

- Unreconciled Appointments: Completed appointments that do not have a matching charge based on Patient and Service Date.

- Complete Write Off: Visits that have gone to a $0 balance, had more than $0 charges, and were the sum of charges equal the sum of adjustments.

- AR Debit Opportunity: The estimated amount of revenue on existing AR based on the historic Gross Collection Ratio of the primary insurance plan.

- AR Debit Denied %: The percentage of Debit AR that has received a Denial.

- AR Debit Insurance >60 Days %: The percentage of Insurance Debit AR still open 60 days after the Service Date (Insurance Debit > 60 Days / Insurance Debit AR)

- AR Debit Self pay >60 Days %: The percentage of Self Pay Debit AR still open 60 days after the Service Date (Self Pay Debit AR >60 Days / Self Pay Debit AR)

- AR Days: The Average number of days it takes a visit from the original Charge Post Date to the $0 balance date (Debit AR / Average Daily Charges) NOTE: Average Daily Charges can be over the past 90,180 or 365 days.

**Executive Summary Notes: WEEKLY to be reviewed

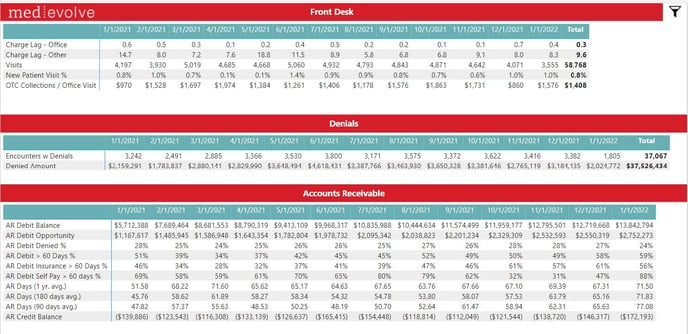

Front Desk

- Keep an eye on charge lag to ensure charges are being posted timely.

- OTC Collections / Office Visit is a good measure of the front desk collecting co-pays and other patient liability that is owed for the services being rendered.

- Visits – Total unique visits in a given month. Keep an eye on the trending and make sure it is aligned with the physician schedules (e.g. more vacation less visits acceptable).

- New Patient Visit % - Shows how many E&M and Consults are new versus return patients. Depending on specialty and organic growth expectations from the practice 15-20+% new patients is acceptable.

- Unreconciled Appts % is important to make sure visits that have been completed have a charge associated with them. If this percent is high it could mean the front desk staff did not complete the visit or assign a “no show or canceled” appointment status. It is important to note that if the charge lag is high that could be impacting this percentage as the KPI for charges within 30 days of the visit.

Edits & Denials

- Encounters w Edits – Visits that encountered an edit, details on edits can be found on the Edits KPI.

- Encounters w Denials – Visits where a first pass denial was received from the insurance company. We show the visit count and the denial amount. You can see denial detail on Denials KPI.

Accounts Receivable

- AR Debit Balance – Current Balance of the total AR excluding credits

- AR Debit Opportunity – Estimated cash opportunity on the current AR

- AR Debit Denied % - % of the AR that has at least one denial on the claim compared to the total number of visits on the open debit AR

- AR Debit >60 Days % - Total outstanding debit AR (insurance and patient) over 60 days from service date / the total debit AR

- AR Debit Insurance >60 Days % - keep an eye on how this is trending month over month. A high % over 60 could mean poor A/R Follow Up among other things. The goal should be less than 20% however for certain medical specialties with very high dollar complex cases or a payer mix in workers compensation and auto, >20% is acceptable. Insurance AR over 60 should never exceed 35%.

- AR Debit Self Pay >180 & 365 % - having a good self-pay follow up process is critical and has to go beyond sending statements. Keeping self-pay AR minimized is key to good balance sheet health however you don’t want to just write off self-pay balances too soon or refer them to hard collections where the cost/commissions can be as high as 30+%. There is not really a benchmark per se on Self-Pay aging however if your over 180 days exceeds 50% and 365 exceeds 10% it is important to look at the tactics being deployed to collect that money. Make sure you are collecting past due balances from all patients who are scheduling another appointment.

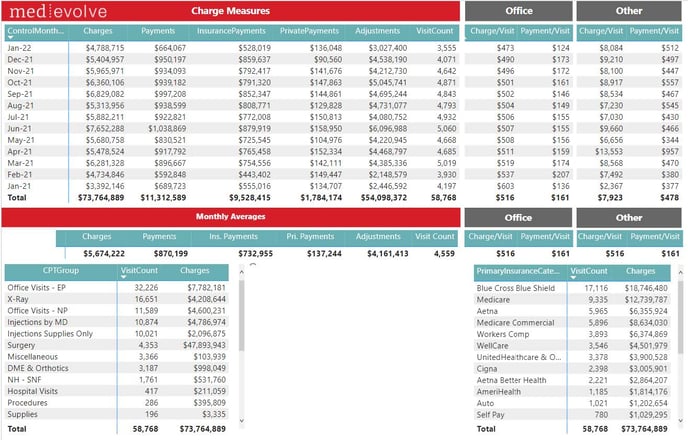

Charge Measures

**Executive Summary Notes: WEEKLY to be reviewed

Charge Measures is a good place to see your transaction data (what has been posted so far in a given month). Remember this KPI is off transaction postdate regardless of the service date. Remember you can select filters on the page by highlighting a row and if you want multiple filters hold down “control” as you select. Also the filter icon in the upper right will allow you to choose more ways to drill down.

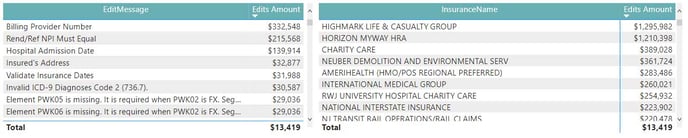

Edits

- Claim Error: Pre-Claim errors from the clearinghouse’s scrubber

- Claim Rejection: Pre-Claim payer edits as reported by the clearinghouse

- Unprocessables: Claim edits from MedEvolve’s claim scrubber

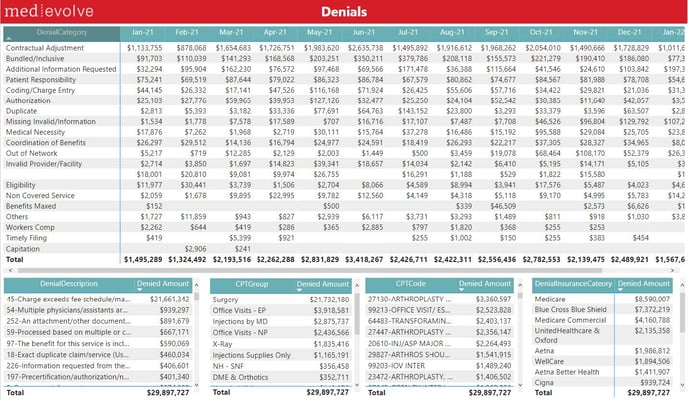

Denials

Slicers:

- Denial: Whether the message from the insurance company is considered a denial or not

- First Pass Denials: The first time a specific denial code appears on a visit

- Open Denials: Any denial on an open balance that has yet to receive an insurance payment

** Executive Summary Notes: WEEKLY to be reviewed

The Denials KPI shows your first pass denials for a given month. It is important to keep an eye on preventable denials such as COB/Eligibility, Authorization, Timely Filing, Benefits Maxed etc. Based on the magnitude of preventable first pass denials it may merit a look at front end financial clearance processes that should be in place prior to any service.

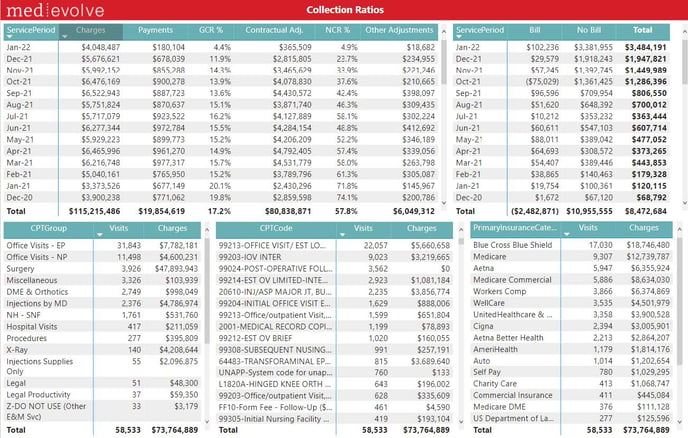

Collections Ratios

Financial transactions listed by Service Period:

- Gross Collection Ratio %: The amount of revenue collected on charges so far (Total Payments / Total Charges)

- Net Collection Ratio %: The amount of revenue collected on the estimated allowable so far (Total Payments / (Total Charges – Contractual Adjustments))

- Monthly Averages: The average monthly values based on the 6 Service Periods starting 3 months ago

** Executive Summary Notes: MONTHLY to be reviewed

Keep an eye on the NCR (3 month prior so if today is Jan 15th you would look at Oct (previous year) and prior). Remember non contractual write offs will impact the NCR. Look at “other adjustments” column to see how much $ is being written off in each month. In addition to Other Adjustments the column for “Bill” which is due from patient and “No Bill” which is due form insurance will also negatively impact NCR. Good A/R Follow Up for insurance and patient debit, along with minimizing avoidable denials is critical for keeping NCR at benchmark levels of (>90%)

Work RVUs:

Work RVUs calculated on CMS standards

Payer Mix Trending:

- Charges %: The percentage of charges by payer category for each month’s total charges

- Payment %: The percentage of payments by payer category for each month’s total payments

- Gross Collection Ratio %: The amount of revenue collected on charges that reached a $0 balance in each given month (Total Payments/ Total Charges)

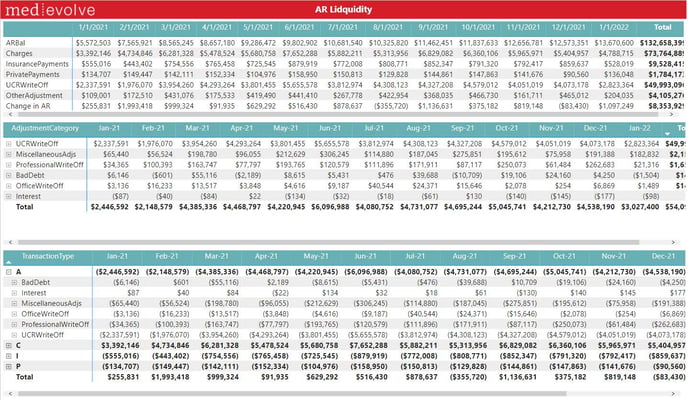

AR Liquidity

- AR Equation / Change in AR: Charges – Payments – Adjustments = Change in AR

- Transaction Categories: Expand each of the transaction categories to see which transaction codes roll up under each group

** Executive Summary Notes: WEEKLY to be reviewed

- The key to this metric is to look at the detail of “Other Adjustment” write offs. Remember this KPI shows the actual wirte off amount and code description used.

- This AR is no longer open on the balance sheet. Look at the “MiscellaneousAdjs” and ProfessionalWriteOff” detail by clicking on the (+) sign to audit the adjustments. Large write-offs for things like bad debit, no authorization, timely filing need to be addressed with staff and mitigation efforts assessed and deployed.

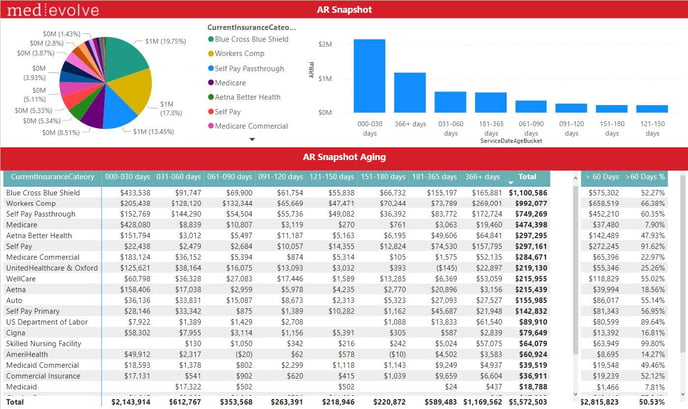

AR Snapshot

- Current Insurance: The last known payer who is responsible for the visit

- Self Pay Primary: AR balances for visits that did not have insurance

- Self Pay Passthrough: AR balances for visits that started with insurance and have since been placed into patient responsibility

- Aging: Aging buckets here are AR balances aged since the Service Date

Slicers:

- Insurance Type: The current payer type responsible for the visit balance

- Patient Credit Debit: AR balances for the patients based on their total owed AR

- Credit Debit: AR balances for visits based on their total owed AR

- Remaining GCR %: The percentage of remaining gross collections on the Charge Amount ( (Total Charges – Total Payments) / Total Charges)

- Insurance Payments_ YN: AR balances that have either received an Insurance Payment or not

- UCRAdjustment_YN: AR balances that have either received a Contractual Adjustment or not

- Denial_YN: AR balances that have either received a Denial or not

- OpenCharge_YN: AR balances that have had their charge entered but not yet posted or not

** Executive Summary Notes: MONTHLY to be reviewed

- This KPI shows your current AR aged in traditional buckets. The over 60 day’s columns are important to note by payer to make sure you are in line with benchmark. Commercial payers should be less than 20% while No Fault/Auto and Workers Comp may trend over 30%.

- Couple things to be careful on are what type of AR you are looking at. When you click on the Filter icon in the upper right you will see a lot of drill down options. Make sure “ControlMonthEndPeriod” is always the current month unless you want to audit past month end’s. Also select “CurrentInsuranceType” of Insurance or self-pay depending on what you are analyzing. Lastly Select Credit or Debit or both. The other filters are very helpful as well like “InsurancePayments” and “ARBal”.

AR Snapshot by Count

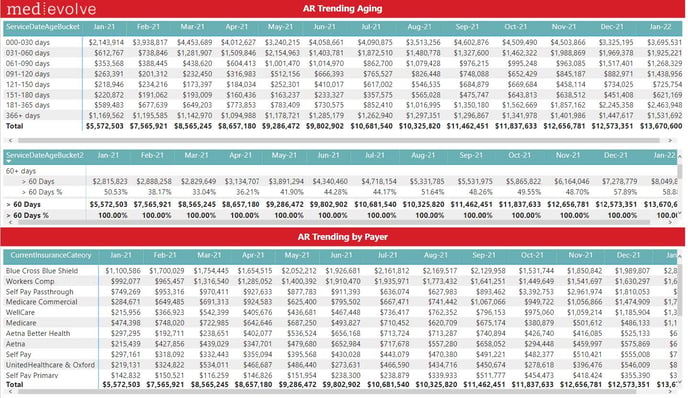

AR Trending

** Executive Summary Notes: MONTHLY to be reviewed

- This KPI shows your AR trending month over month by aging bucket. This KPI is aged off the service date not the file date. Similar to the AR Snapshot KPI make sure you set filters for debit versus credit, insurance versus patient etc. Look at the aging buckets if you start to see the older aging buckets growing that is a red flag and mitigation steps should be taken to understand why that older AR is not paying.

- Click on certain Insurance Category’s in the bottom KPI to see how certain payers are trending. This will help you see where the growth of aged AR is occurring and allow you to put a plan together around certain payers.

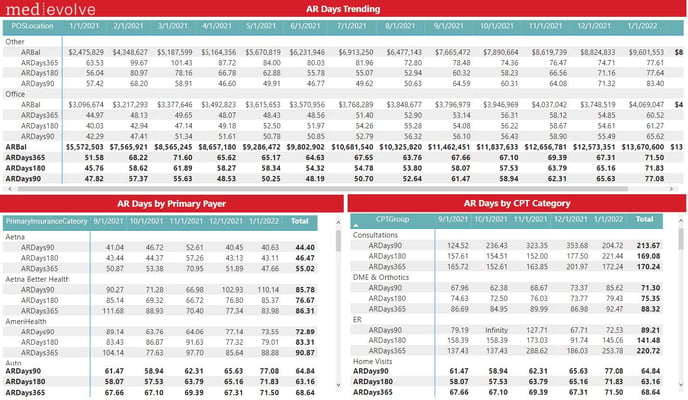

AR Days

** Executive Summary Notes: MONTHLY to be reviewed

- We show AR Days calculated in three ways. The difference is how we are calculating average daily gross charges (90 vs 180 vs 365). Most conservative and removed seasonality is to look at 365 days. However if there were major events that disrupted visits/charges a 90 or 180 may be more accurate (e.g. COVID impact for March- May 2020 charges)

- Benchmarks for AR days very based on payer but a good rule of thumb for Medicare and commercial managed care (in network) is less than 30 days. Medicaid, out of network, workers comp/auto and other slow payers could be as high a 45-60 days.

- NOTE: 90 vs 180 vs 365 is contingent on how long and how much data you have accumulated in MedEvolve PM. e.g. 90 days you must have at least 3 months, 180 days must have at least 6 months, 365 days you must have at least a year’s worth of data.

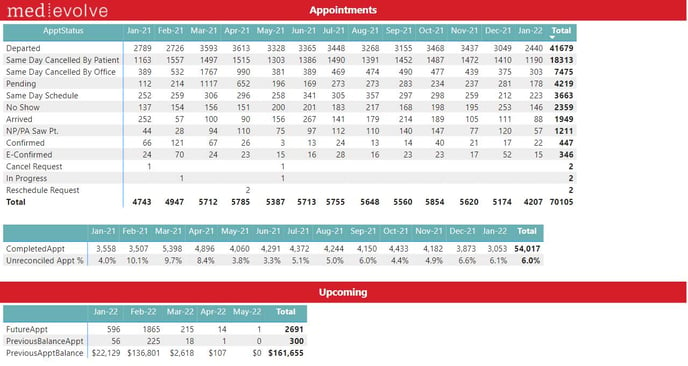

Appointments

- Previous Balance Appointment: The number of appointments scheduled where the patient has an open Bill Balance.

- Previous Appointment Balance: The Bill balance owed by patients with appointments scheduled.

** Executive Summary Notes: MONTHLY to be reviewed

Keep an eye on the trends of certain Appointment Statuses. IF the front desk is not following the correct process for arriving and departing patients your data will be impacted. I recommend an audit of “pending” to make sure there is an explanation of why these appointments have not been completed/departed or cancelled/no show.

Features

| Show Slicers Panel | |

|

Show Export Data Panel. Hover over the new table to show (. . .) More options in the upper right hand corner, then choose Export Data, followed by underlying data. |

|

|

Dynamic Fields: Click the two down arrows button to show the values by a different dimension. Click the up arrow button to go back. Dynamic fields are available on Charge Measures, Collection Ratios, Work RVUs, and Denials. |

|

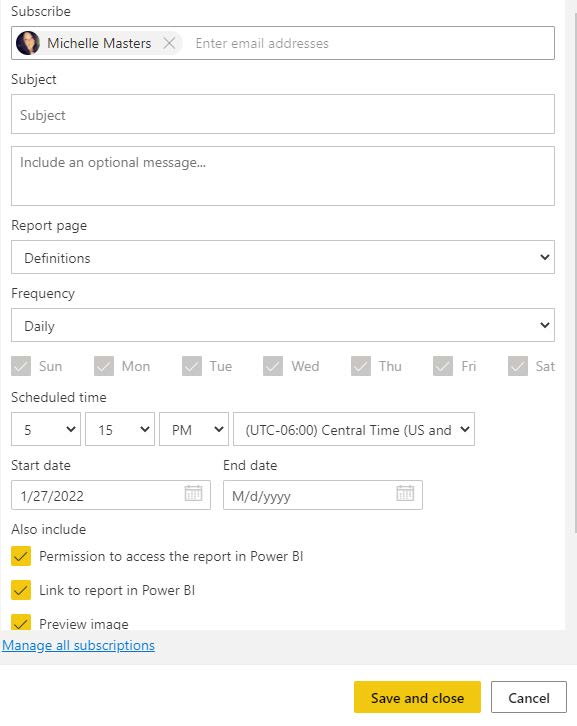

Allows the user to set up emails to Subscribe to emails for specific reports. |

|

|

Next you will be able to set up subscriber, subject, and optional message to the subscriber, report, frequency, scheduled time, and start and end dates. |